| SGX-listed Nam Cheong Ltd has a unique dual identity as both a vessel owner-operator and a shipbuilder. The latter role used to be the key role which saw the company deliver more than 150 offshore support vessels (OSV), particularly during the oil boom years prior to 2014. When the downturn stretched into years and shipbuilding orders dried up, Nam Cheong acquired and built up a fleet and morphed into a charterer. While 100% of current revenue is derived from OSV chartering, the management is eagerly awaiting a resurgence in shipbuilding revenue from external parties.

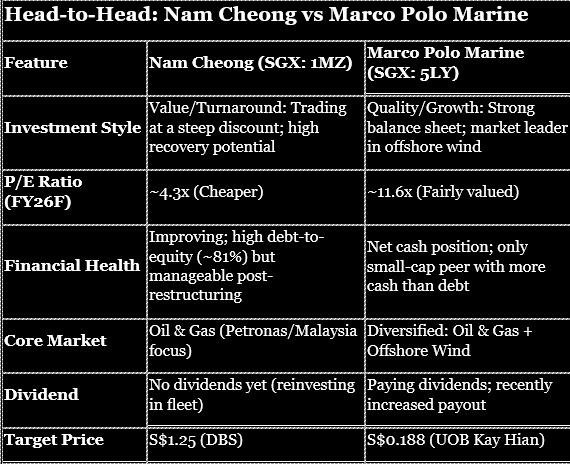

That is an important takeaway from the SIAS Corporate Connect session this week (video at the bottom) featuring CEO Leong Seng Keat and CFO Chong Chung Fen. According to SIAS, Nam Cheong (market cap: S$422 million) is looking attractively priced vis-a-vis peers, as its comparision table shows:  Source: SIAS Source: SIAS |

| #1. Resurgence in Shipbuilding Interest |

Investor questions: "Can you provide us updates on the Petronas Safina Phase 2, and are we building any new OSV for Safina Phase 2? Do you see that Safina will help Nam Cheong get the first deal in the shipbuilding business in the coming year?"

Project Safina is a multi-phase new-build program initiated by Petronas to renew and secure the supply of OSVs for its upstream production operations in Malaysia. Phase 2 has been delayed by more than a year now and a tender has yet to open.

CEO Leong said, in the meantime, Nam Cheong is seeing "plenty of inquiries" for new ships from international owners.

"Besides Safina, we have received many other inquiries. We have many international owners that we are working with. We believe those are even more fast-tracked than the Malaysian Safina."

This surge in inquiries is driven by a global aging fleet—where the average OSV age is 15 to 16 years—and a tight supply of shipyard capacity worldwide, he said.

Nam Cheong is one of the few players ready to meet this demand.

This potential income from the shipyard—the "newbuild" money—is currently not factored into the company’s current valuation. This potential alone could add an incremental fair value of SGD0.13 to SGD1.15 per share, says DBS Group Research.

| #2. Strategic Fleet Reprofiling |

Unlike "pure-play" vessel owners who must buy assets at market prices, Nam Cheong utilizes its own yard in Miri, Sarawak to build for its own fleet.

This "build-at-cost" advantage is central to their reprofiling strategy.

The company aims to maintain a young and advanced fleet, currently averaging just 9 years old.

By building new vessels for themselves, they can sell older assets while they still command high value, ensuring their operational fleet remains highly competitive and efficient.

For 2026, the company -- which has 37 vessels currently -- aims to add six new-built vessels to its fleet—three in the first quarter and three at year-end.

| #3. Understanding "Core" Profits: The CFO’s Explanation |

Investor question: "Why do you consider vessel disposal gains as part of the core profit of Nam Cheong?" Chong Chung Fen, CFOCFO Chong explained that while most companies treat asset sales as one-off events, Nam Cheong views them as part of their core recurring profit.

Chong Chung Fen, CFOCFO Chong explained that while most companies treat asset sales as one-off events, Nam Cheong views them as part of their core recurring profit.

Because the company is a shipbuilder by trade, the cycle of building, chartering, and eventually selling a vessel is a fundamental part of their business model.

Between FY2022 and FY2024, the group recorded consistent annual gains from vessel sales of RM40-60 million.

By classifying these as core profits, the company reflects the true nature of its integrated shipbuilding-and-chartering operations.

| #4 Looking Toward a Normalised 2026 |

Investors tracking the 2025 performance may have noticed some weakness in charter income during the first half of the year.

Mr. Cheong clarified that the lower utilization rates in Q1 and Q2 were due to the company preparing vessels to commence long-term charter contracts.

This "downtime" was an investment in future stability.

By Q3 2025, revenue began to rise as these long-term contracts kicked in.

-

4Q 2025: Expected to reflect a more "normalised" operational state as the fleet fully engages with its secured contracts.

-

2026 Outlook: With 60% of the fleet already secured under long-term contracts and six new vessels joining the fleet, 2026 is poised to be a year of high visibility and steady earnings.

A recording of the webinar is here:

See also: Upcoming Rise of Newbuilds: NAM CHEONG's Latest Move Boosts BUY Case For $1.25 Target