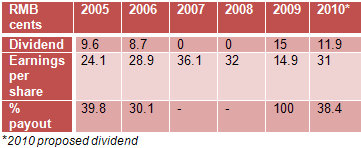

BRIGHT WORLD PRECISION MACHINERY is proposing to pay out a final dividend that is about 77% of its end-2010 cash balance and 38% of its net earnings for 2010.

Yes, it's an S-chip – a rare one as most S-chips pay little or no dividend.

Bright World, a manufacturer of stamping machines (like cookie cutters) that produce components for industries such as automobile and home appliances, is proposing a final dividend of RMB0.119 (equivalent to S$0.023) per share.

This big payout is the second successive year of such payouts.

For FY2009, when its year-end cash balance was lower at RMB57.0 million, it paid out an even higher RMB0.15 (equivalent to S$0.03) per share. At that time, the shares were trading at the 20-cent level, which implied a yield of 15%.

The payout was to reward long-suffering shareholders who had not received any dividend for FY2007 and FY2008 as a result of an impending takeover offer (which later failed) and because of a business downturn during the global financial crisis.

Going further back, when times were better in 2006 and 2005, Bright World demonstrated its readiness to pay dividends (and its strong operating cashflow) by dishing out 8.7 RMB cents and RMB9.6 cents a share, respectively.

An interesting thing to note is that there was even a payout for 2005, considering that Bright World was listed on the Singapore Exchange in April 2006.

And now an even bigger surprise: Taken together, the dividend payouts for FY2005-2010 (assuming the FY10 dividend is approved at the upcoming AGM) total 45.2 RMB cents, which is about S$36 million based on issued share capital of 400 million (unchanged since IPO).

This dividend sum is higher than the S$32.4 million in net IPO proceeds (or S$37.8 million of gross proceeds) that Bright World collected.

On top of that, Bright World has risen from its IPO price of 36 cents to 58 cents yesterday, for a gain of 61%, so there are many happy minority shareholders out there.

Bright World doesn’t have a fixed dividend policy but payouts are usually 30-40% of the net profit after taking into consideration any expansion plan and capex, said Mr Cheng Hong, its non-executive director and non-independent director, at a presentation to investors at CIMB.

If that payout ratio is maintained, there will be more dividends coming (the current yield is about 4% as the stock price has moved up) because after a 113% surge in net profit to RMB125.2 million last year, Bright World is poised for continued strong growth, according to its CEO in an interview with Reuters last week.

Mr Shao Jian Jun said: "We target at least 40 percent growth in sales this year. In the next three to five years, we will still see high growth."

Propelling the company's business is demand from China's domestic car makers who are looking to sell higher‐end cars, translating into greater demand for more sophisticated and advanced stamping machines that Bright World produces.

The company, which derives about 32 percent of its sales from the automotive business, hopes to see sales from this segment increase by 40‐50% this year, Mr Shao said.

Bright World also hopes to see its sales to home appliance makers, which account for about 34% of revenue, to rise by about 30% this year, Mr Shao said, as demand for consumer electronics rises along with greater urbanisation in China.

While he didn’t give a gross profit margin target, investors at CIMB on Tuesday heard of Bright World’s expectations of an improved gross profit margin this year compared to the 26% achieved last year.

Taken together, a surge in sales and a stronger profit margin can only mean one thing - Bright World's profit growth this year can be expected to be stellar.

Bright World CEO's interview with Reuters last week can be read here in full.

Recent stories:

a) BRIGHT WORLD: Receives Stamp Of Approval With Record Order

b) BRIGHT WORLD, SINO GRANDNESS, UMS: What analysts now say.....