- Posts: 147

- Thank you received: 5

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Stocks to Watch

8 years 1 month ago #24210

by walterlim

Replied by walterlim on topic Stocks to Watch

expecting buying interest of Tat Seng to increase ahead of financial result release in Feb. As indicated in Hanwell's report previously, revenue and net income of Tat Seng has helped to boost its earnings. Should be expecting Tat Seng to do well

Please Log in to join the conversation.

8 years 1 month ago - 8 years 1 month ago #24238

by pine

Replied by pine on topic Stocks to Watch

www.theedgesingapore.com/delong-74-share...eelmaker-undervalued

The Edge Singapore

HOT STOCK

Delong up 7.4% as shareholder Evraz says steelmaker 'undervalued'

By: PC Lee

23/01/18, 12:05 pm

SINGAPORE (Jan 23): Delong Holdings, the Singapore-traded steelmaker with assets in China, jumped 26 cents to $3.76 with 182,000 shares traded.

The stock has risen 44% since Evraz Plc, a Russia steelmaker that owns a 15% stake in Delong, said in a Dec 2017 interview with Bloomberg that the company was undervalued because large investors have long ignored the stock.

Fair value could be US$4 billion to US$5 billion , compared with its current market value of about $200 million , said Aleksey Eberents, director for corporate strategy for Evraz in an emailed interview.

Delong’s enterprise value to EBITDA was less than 1, compared with a typical ratio in China of 10 to 12. Ebitda would be US$390 million in 2017, highest in seven years, he added.

Delong has US$620 million in cash and planning new projects, which could increase its value.

If the value of Evraz’s stake in Delong increased, then the company may sell it to fund other projects or pay higher dividends, Oleg Petropavlovskiy, analyst at BCS Global Markets, was quoted by Bloomberg as saying.

The Edge Singapore

HOT STOCK

Delong up 7.4% as shareholder Evraz says steelmaker 'undervalued'

By: PC Lee

23/01/18, 12:05 pm

SINGAPORE (Jan 23): Delong Holdings, the Singapore-traded steelmaker with assets in China, jumped 26 cents to $3.76 with 182,000 shares traded.

The stock has risen 44% since Evraz Plc, a Russia steelmaker that owns a 15% stake in Delong, said in a Dec 2017 interview with Bloomberg that the company was undervalued because large investors have long ignored the stock.

Fair value could be US$4 billion to US$5 billion , compared with its current market value of about $200 million , said Aleksey Eberents, director for corporate strategy for Evraz in an emailed interview.

Delong’s enterprise value to EBITDA was less than 1, compared with a typical ratio in China of 10 to 12. Ebitda would be US$390 million in 2017, highest in seven years, he added.

Delong has US$620 million in cash and planning new projects, which could increase its value.

If the value of Evraz’s stake in Delong increased, then the company may sell it to fund other projects or pay higher dividends, Oleg Petropavlovskiy, analyst at BCS Global Markets, was quoted by Bloomberg as saying.

Last edit: 8 years 1 month ago by pine.

Please Log in to join the conversation.

7 years 10 months ago #24319

by yeng

Replied by yeng on topic Stocks to Watch

ISOTEAM is showing fantastic technicals, and FA.

Share price jumped from 33 cents two weeks ago and touched 37.5 cents today.

Company did share buyback in Feb and followed that up with $24 m contract wins announcement.

Share price jumped from 33 cents two weeks ago and touched 37.5 cents today.

Company did share buyback in Feb and followed that up with $24 m contract wins announcement.

Please Log in to join the conversation.

7 years 10 months ago #24327

by yeng

Replied by yeng on topic Stocks to Watch

Fu Yu, for your consideration:

1. Final Dividend 1.5 cents. (252% payout ratio!).

2. No borrowings. Cash = $95 million!

3.Market cap = $143 millon.

4. Top 20 shareholders include: 2G Capital (6 million shares) & Jeremy Lee (6 million shares).

1. Final Dividend 1.5 cents. (252% payout ratio!).

2. No borrowings. Cash = $95 million!

3.Market cap = $143 millon.

4. Top 20 shareholders include: 2G Capital (6 million shares) & Jeremy Lee (6 million shares).

Please Log in to join the conversation.

7 years 8 months ago #24389

by Big Fish

Replied by Big Fish on topic Stocks to Watch

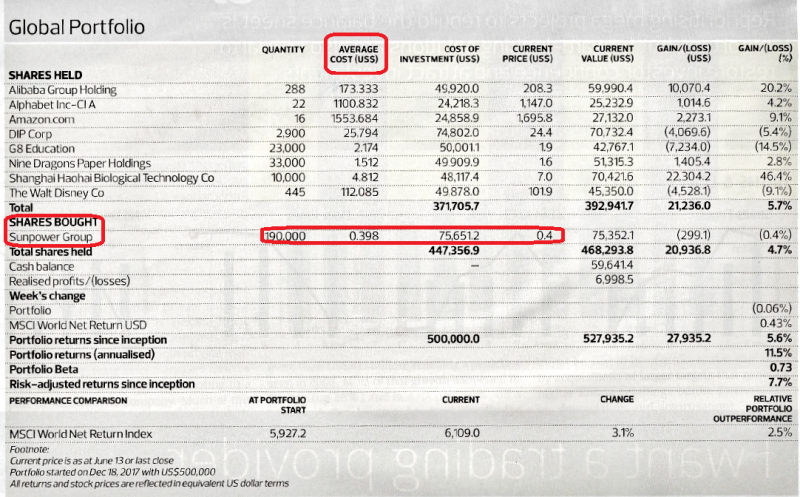

Sunpower is up 10 cents in 2 weeks --> 60 cents today. Sunpower is going to be the next China Sunsine. Why? Sunsine's competitive edge lies in its environmental standards. Sunpower's edge is in using its technologies to bring about higher environmental protection. In China, if you are a major player in one way or another in helping the environment, you are ahead of your peers.

Please Log in to join the conversation.

Time to create page: 0.285 seconds