Excerpts from analyst reports

OSK-DMG ups Yangzijiang Shipbuilding's target from 95 cents to $1.00

Analysts: Lee Yue Jer and Jason Saw

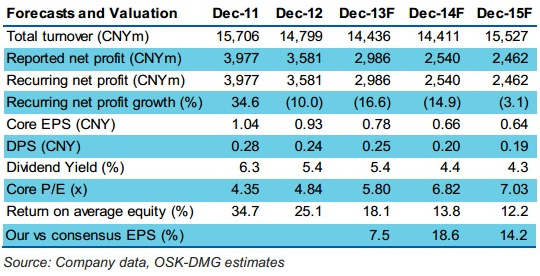

Ren Yuanlin, executive chairman of Yangzijiang. Company photoWe raise our FY13F-FY14F EPS by 9%-14% as we now expect a slower decline in HTM (held-to-maturity) investments. We remain NEUTRAL amid improving ship demand vis-à-vis still-weak pricing, with our revised TP at SGD1.00.

Ren Yuanlin, executive chairman of Yangzijiang. Company photoWe raise our FY13F-FY14F EPS by 9%-14% as we now expect a slower decline in HTM (held-to-maturity) investments. We remain NEUTRAL amid improving ship demand vis-à-vis still-weak pricing, with our revised TP at SGD1.00.

OSK-DMG ups Yangzijiang Shipbuilding's target from 95 cents to $1.00

Analysts: Lee Yue Jer and Jason Saw

Ren Yuanlin, executive chairman of Yangzijiang. Company photoWe raise our FY13F-FY14F EPS by 9%-14% as we now expect a slower decline in HTM (held-to-maturity) investments. We remain NEUTRAL amid improving ship demand vis-à-vis still-weak pricing, with our revised TP at SGD1.00.

Ren Yuanlin, executive chairman of Yangzijiang. Company photoWe raise our FY13F-FY14F EPS by 9%-14% as we now expect a slower decline in HTM (held-to-maturity) investments. We remain NEUTRAL amid improving ship demand vis-à-vis still-weak pricing, with our revised TP at SGD1.00.Confidence in winning more orders. YZJ has a net orderbook of USD3.24bn comprising 29 container ships and 42 bulk carriers.

YTD, it has secured USD1.01bn in new orders for 27 ships, and Management is confident of winning another USD1.0bn-USD1.5bn for 2H13.

We think this is achievable as YZJ has 47 options valued at USD2.54bn with various buyers, which we expect will translate into firm orders.

Faster recovery but no near-term catalysts in sight. We believe YZJ will recover from the current downturn faster than its peers given its industry-leading capabilities.

However, we are still NEUTRAL on the stock given the lack of catalysts as new orders are likely to fetch lower margins while earnings momentum remains negative.

We believe investors may like to see more proactive capital management on the company’s part before becoming more positive on the stock.

YTD, it has secured USD1.01bn in new orders for 27 ships, and Management is confident of winning another USD1.0bn-USD1.5bn for 2H13.

We think this is achievable as YZJ has 47 options valued at USD2.54bn with various buyers, which we expect will translate into firm orders.

Faster recovery but no near-term catalysts in sight. We believe YZJ will recover from the current downturn faster than its peers given its industry-leading capabilities.

However, we are still NEUTRAL on the stock given the lack of catalysts as new orders are likely to fetch lower margins while earnings momentum remains negative.

We believe investors may like to see more proactive capital management on the company’s part before becoming more positive on the stock.

Recent story: YANGZIJIANG: Rmb 1.5bn Profit Accounts For Half Of PRC Sector's In 1H2013

SIAS Research pegs Roxy-Pacific's intrinsic value at 79.5 cents

Analyst: Liu Jinshu

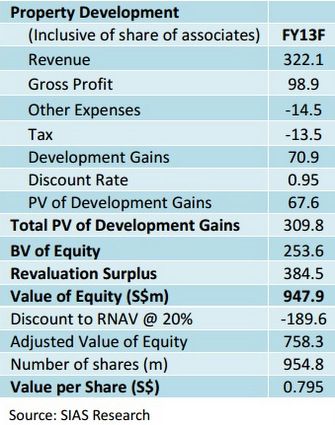

Roxy-Pacific Holdings Limited (Roxy) reported a positive set

Roxy-Pacific Holdings Limited (Roxy) reported a positive set

of 2Q FY13 results with net profit growing by 10% Y-o-Y.

The completion of WiS@Changi will bump profit growth

higher in 2H FY13. Pre-sales at recent Roxy’s launches

have been strong and Roxy has started participating in

overseas projects, with a development in KL.

We

We

incorporated Roxy’s recent land acquisitions into our model,

which raised intrinsic value to S$0.795 versus S$0.710.

We

We

continue to like Roxy for its forward earnings visibility given

its progress billings of S$1.1bn to be recognized from 3Q

2013 to FY17.

Roxy’s project pipeline now consists of two more launches

in each of 3Q and 4Q 2013 and at least two launches in

2014. As such, we can expect steady progress billings

renewal as Roxy recognizes revenue from pre-sales at the

same time.

Recent story:

Recent story:

ROXY-PACIFIC: $1.1 Billion In Revenue Yet To Be Booked