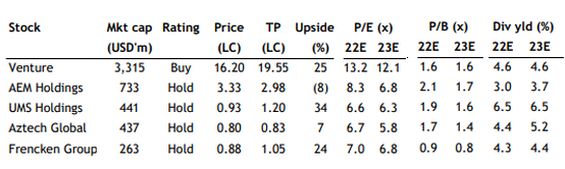

Excerpts from Maybank KE report

Analyst: Jarick Seet

Venture (VMS SP): Likely a positive 3Q22E

| One of the few bright spots in the sector Venture’s 3Q22E results announcement on 4 November 2022 should be positive as demand from customers remained strong and it has a robust order book.

Venture remains one of the few bright spots in the Singapore tech sector amid a challenging climate and is our top sector pick. Maintain BUY. TP of SGD19.55 is based on 16x FY22F P/E. |

||||

The market is looking beyond FY22E

Venture’s FY23 outlook and order book, as well as margins should be investors’ focus. We believe Venture’s near-term positive results are likely already priced in and the uncertain macro outlook that has caused a derating in the tech sector globally will need some assurance in terms of FY23E earnings before any meaningful positive re-rating will come.

Attractive yield is a good hedge

Management declared a 1H22 dividend of SGD0.25 per share and we expect a final dividend of SGD0.50 per share, same as previous years.

This would represent an attractive 4.7% yield for FY22E, which would make it worthwhile for investors to hold Venture for a positive re-rating while fundamentals remain strong.

Resilient and well-diversified Jarick Seet, analystDespite rising costs, Venture has shown that it has managed these challenges well, which also highlights its strong customer ties as it is able to pass on the higher costs to clients. Jarick Seet, analystDespite rising costs, Venture has shown that it has managed these challenges well, which also highlights its strong customer ties as it is able to pass on the higher costs to clients.It is also well diversified away from the semi-con sector and Venture remains one of the few bright spots in the Singapore tech sector. |

Full report here covering AEM, Frencken, Aztech and UMS also.