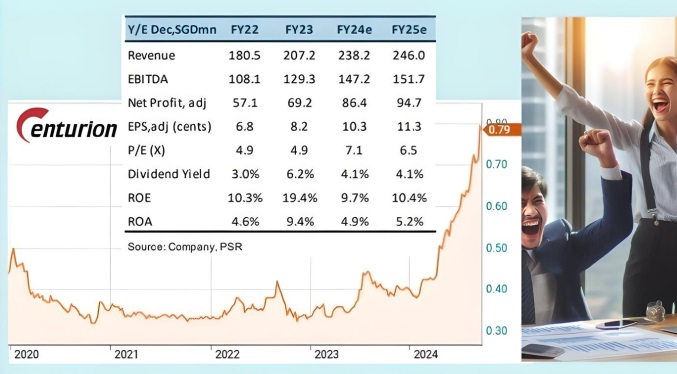

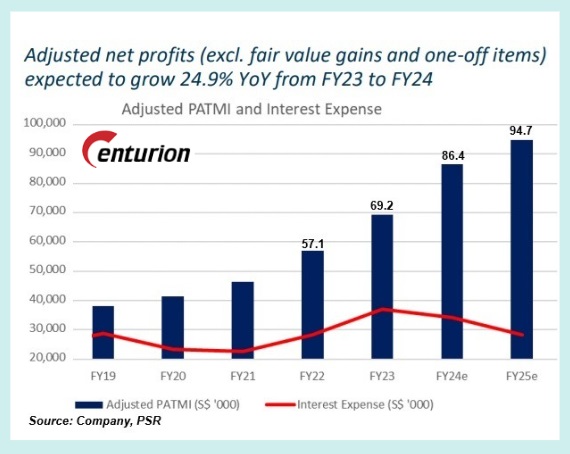

• Centurion's stock surge this year evokes disbelief. It has soared from 40 cents to nearly 80 cents. • The stock had been languishing in recent years despite its fundamentals getting stronger and more obvious during the Covid-19 pandemic. Aptly, as Charlie Munger once said, "The big money is not in the buying and the selling but in the waiting."  Chart: Reuters Chart: Reuters• In March 2023, when the stock hovered at 33 cents, Centurion said in an article, commenting on its sterling FY2022 results: "With travel restrictions and pandemic management measures lifted, both migrant workers and students have started to return in large numbers across the countries where we operate. Our financial occupancies have in turn recovered to pre-COVID levels." • Currently, demand for its accommodation -- from migrant workers in Singapore and students in overseas universities -- continue to be elevated, translating into strong rental rates and profits. • Now there's a new gift -- lower interest rates on its debt (as the chart below shows).  But supply of worker accommodation in Singapore is catching up. So, as Phillip Securities forecasts, the shortage "will probably trend towards zero, but after 2025 based on our predictions." Read more in excerpts below ... |

Excerpts from Phillip Securities' initiation report

Analyst: Yik Ban Chong (Ben)

|

Investment Merits

1. Shortage of beds to meet strong demand from construction contracts awarded in Singapore expected to persist. The Building and Construction Authority (BCA) estimated that between $$31bn to $$38bn in construction contracts are expected to be awarded from 2025-2028.

It is higher than pre-pandemic average of $$29bn, due to major public sector projects over the next few years such as Changi Airport Terminal 5.

Demand for beds from work permit holders from Construction, Marine Shipyard, Process (CMP) sectors can grow by at least 2% YoY to c.450k by Dec 24.

In comparison, government's pipeline of supply is expected to reach c.438k beds by Dec 2024.

There will still be a shortage of c.12k beds by Dec 2024. We expect shortage of worker accommodations in Singapore to persist till end 2025, which helps the Group in raising rental rates by 20% YoY in Singapore PBWA in FY24 and maintaining its high occupancy rates.

2. Growth from purpose-built student accommodation (PBSA) segment in UK. UK's PBSA occupancy increased from 70% in 2020 to 93% in 2023, and we believe it will remain above 95% for the next two years.

In-person classes post-pandemic and 24% higher student acceptances into UK universities compared with the pre-pandemic period is driving demand for PBSA beds.

Supply of PBSA beds in UK is also expected to trend lower beyond 2024 due to supply constraints like debt costs and high construction costs, with an estimated shortfall of 580k beds nationally.

We expect the occupancy rates of UK PBSA to remain above 95% for FY24 and FY25, and rental rates to grow at a healthy range of 5-6% annually.

|

3. Net profits are expected to grow from interest rate cuts. For every 50bps cut in Fed funds rate, we expect interest expense to decrease by c.$2.8mn (c.2.2% of total expenses). We initiate coverage with an ACCUMULATE rating and a price target of $$0.90, based on DCF valuation (EV/EBITDA 8.8, WACC 7.0%). |

Full report here.