|

|

Read AEM's own words in a new SGX filing, in response to a shareholder question ahead of its AGM:

| Q: Has AEM had conversations with its customers or potential customers in relation to the string of tariff announcements made by the U.S.? If yes, what are the key areas of discussion? A: The evolving global trade landscape, especially under the current U.S. administration, has introduced a heightened level of unpredictability in the business world. For AEM, U.S. shipments account for a modest share of revenue (~16.2% in 2024, ~19.9% in 2023). In the Test Cell Solutions (“TCS”) segment, the majority of AI and HPC chip manufacturing – including chip testing – takes place outside of the U.S.. As a result, most of AEM’s test equipment is shipped internationally and remains largely unaffected by U.S. tariffs. We have close relationships with our customers both in the TCS and Contract Manufacturing segments and are actively engaged with them in navigating the current environment of tariffs changes. Our customers recognise AEM’s strengths and advantages, and these strong partnerships allow us to be agile and confident. |

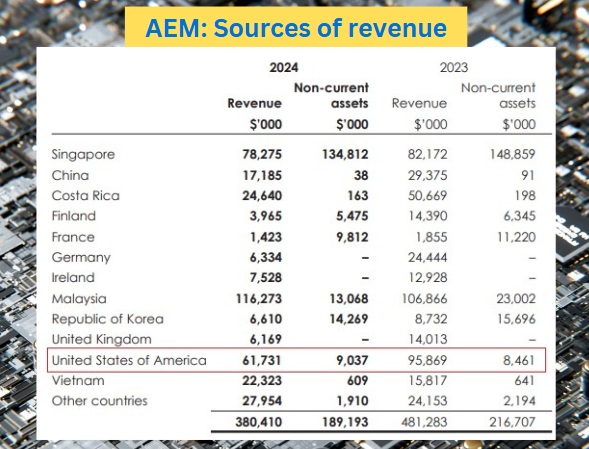

A check of AEM's 2024 annual report gives a broader picture of where it derived its revenue:

One may wonder at the existence of some countries in the above list, such as Vietnam, Costa Rica, Ireland and Germany. Intel does have manufacturing sites in those countries.

Further clues can be found in the annual report listing of AEM's subsidiaries and their principal activities are.

So this is what they do where:

|

Vietnam: a) Printed circuit board assembly and contract manufacturing. This comes under AEM's contract manufacturing business and does not involve Intel. |

The full Q&A between shareholders and AEM is here.

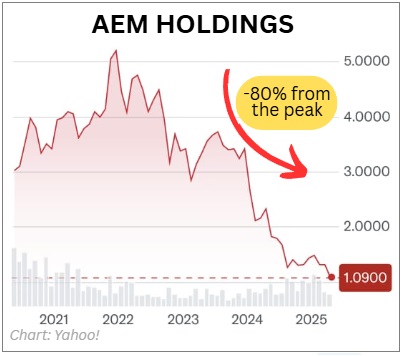

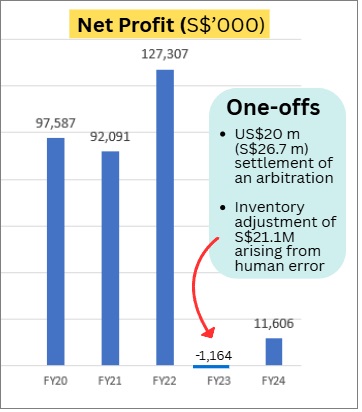

Meanwhile, the stock price of AEM has been a rough ride for shareholders, hitting $1.09 recently for a market cap of S$341 millon.  That's down by 53% in the past 12 months. That's down by 53% in the past 12 months. It's likely due to a combination of AEM's muted revenue guidance for 1H2025, and all the noise about US tariffs affecting the tech sector, among others. As AEM's response to shareholders points out, the US tariffs are a non-material matter. After a record breaking profit in 2022 was followed by a disastrous 2023 (when one-offs knocked the wind out of AEM) analysts expect 2H2025 to be an inflexion point for AEM.  AEM's cutting-edge testing equipment has won new global customers and revenue from them will ramp up to triple-digit millions in 2025 (per management guidance). AEM's cutting-edge testing equipment has won new global customers and revenue from them will ramp up to triple-digit millions in 2025 (per management guidance).Management says these are multi-year, "sticky" projects with significant long-term revenue potential, and the full financial impact will build as production ramps. See: AEM: 2025 forecast affirmed -- triple-digit million revenue from new customers |

|

Aspect |

2025 Outlook for New Customers |

|

Revenue |

> S$100 million (triple-digit millions) |

|

Ramp Timing |

Strongest in 2H25; production begins late 2024 |

|

Key Products |

AMPS-BI (AI chips), PiXL thermal tech |

|

Customer Base |

5+ new accounts, not tied to Intel |

|

Market Focus |

AI, memory (GDDR7), advanced packaging |

"A stronger 2H25 is expected, driven by a recovery in contract manufacturing and potential product ramp-ups. Looking ahead, we anticipate a stronger 2H25, driven by the ramp-up of key customers' devices and some recovery in the contract manufacturing segment.

"The AI customer’s pushout of system shipments into 2H25 also alludes to a better 2H25, given that their data centre sales will be flattish h/h in 1H25 and production ramp-ups of its upcoming product will only occur from mid-year onwards."

-- Amanda Tan, analyst, DBS Research,

3 March 2025.