AEM’s Big Year: AI Chips, Chiplets, and Enhanced Business Model

|

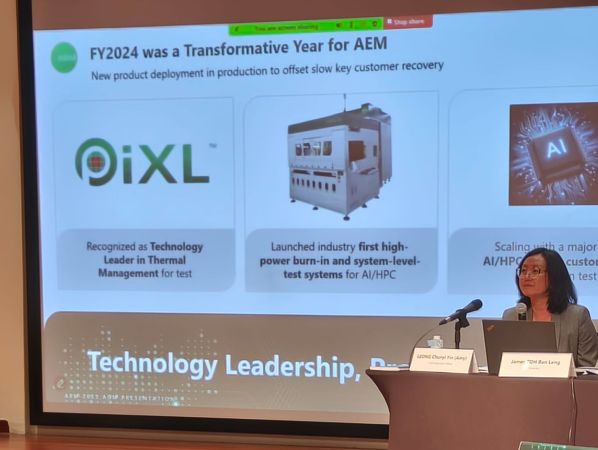

A Transformative 2024 2024 was a game-changer for AEM, with the company making big moves in its core test and automation segment. |

AI Chips & Chiplet Manufacturing: The Growth Drivers

As AI chip adoption grows at a rapid pace, so does the demand for sophisticated testing equipment that can handle the complexity and power requirements of these new packages Amy explained, “The more AI chips, the more needs to be tested, and the more test equipment is required.”

Amy explained, “The more AI chips, the more needs to be tested, and the more test equipment is required.”

She pointed out that chiplet manufacturing—a new, complex way of building AI chips—brings a whole new set of testing challenges.

These chips can consume up to 2 kilowatts each, and their chiplet-based designs mean different parts can have wildly different thermal profiles.

That makes it tough to keep everything cool and running smoothly during tests.

Plus, as more chiplets are packed together, test times get longer, and ensuring all the parts work together flawlessly is a headache.

AEM has stepped up with automated, high-power burn-in systems and advanced thermal management to tackle these issues.

Razor-and-Blade Business Model

Chiplet manufacturing means customers can swap out just one chip for a new feature or bug fix, speeding up product cycles to as little as 9–12 months.

For AEM, this creates a “razor and blade” model—sell the main system once, then keep selling consumables and upgrades as customers roll out new products.

As AI and chiplet adoption matures, recurring business from these consumables is set to more than double the initial system sale, said Amy.

|

Diversifying for Industry Leadership AEM, once reliant on a single major customer, Intel Corp, has spent the past five years transforming its business and expanding its reach in the high-performance technology sector. Recognizing the shift from simple, single-die chips to complex multi-die and chiplet designs, AEM made a decisive investment in advanced thermal technology. "We've made a concerted effort to create powerful patents around these technologies and, more importantly, interlink those patents to create a fence. You can have strong patents, but they can be very powerful if you connect them together to become like a fence.

AEM’s approach is to meet customers where they are, offering a spectrum of solutions from affordable Gen-1 pixel technology to advanced systems for cutting-edge AI chips. |

Non-Executive Chairman Loke Wai San (extreme right) with independent directors Alice Lin and André Andonian.

Non-Executive Chairman Loke Wai San (extreme right) with independent directors Alice Lin and André Andonian.

Below are edited excerpts from the AGM:

Q: Can you explain how big the market is for AEM, and who are your main customers and competitors? Are you competing with companies like Advantest?

Non-Executive Chairman Loke Wai San:

Let’s go into some history and our current strategy. Publicly, it’s known we started with Intel, which for the last five years has been the largest consumer of test equipment. Shareholders ask us: Have you thought about diversifying?

Yes, but it is not easy. Because there is a bunch of folks who will fight tooth and nail to defend their turf and the only way you can dislodge an incumbent is to come up with something fundamentally disruptive that the market needs.

Amy talked about chiplets intensifying test requirements and escalating test costs. That was the moment we have been waiting for. That's our sunrise.

We announced a major customer, one of the top 2 GPU (graphics processing unit) companies adopting us. The key point here -- getting into the lab for evaluation is good, but no big deal…. you give them a tool to play around for two years.

But to go into a mission critical zero-failure production environment, that is another level. It's not just your technology, but also your field service has to be there. Your troubleshooting needs to be there, all the logistics need to be there. It's a different kind of situation and scale.

We're scaling with one of the major AI players. To get to that point, we had to displace some major company. And so your company, AEM, has done that. And we're hopeful we will get into another company, another customer in memory and will displace another two global companies.

Again, if you are one of the incumbents of 20-40 billion market cap you're not going to give up the top AI customer easily to a small company from Singapore, right?

Q: What are the impacts of tariffs and trade wars on AEM’s business?

Non-Executive Chairman Loke Wai San:

The trade war has two levels of impact. In the short term, the effect on us is minimal since test equipment is a small part of overall manufacturing costs, and most of our activities are outside the US.

The bigger concern is the long-term effect on global demand for electronics. If trade tensions persist, it could eventually reduce demand for electronic devices and services, but for now, the immediate impact on us is small.

(For more, see:AEM: US Tariffs? Little Impact as This Company's Equipment Ships to Other Countries)

The PowerPoint deck used at the AGM is here.