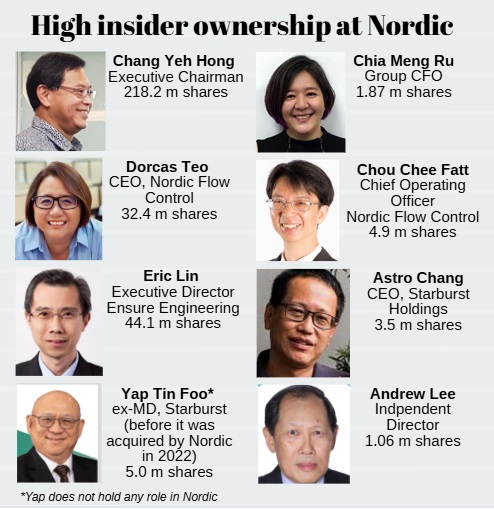

| Some Singapore-listed companies still experience the market's non-recognition, even after a rally in small and mid-caps this year. Take Nordic Group, which has delivered creditable performance year in, year out, generating annual EBITDA of S$29 million on average in the past 3 years.  Chang Yeh Hong, executive chairman. Chang Yeh Hong, executive chairman.

Part of the reason has to do with the senior management owning some three quarters of the stock, so there is relatively little liquidity and no analyst coverage. |

Data: FY2024 annual report

Data: FY2024 annual report

If you’re looking for stability and cash generation, Nordic Group just delivered some reassuring nine-month results.

Since its 2010 listing, Nordic has never had a loss-making year, nor has it needed to raise fresh capital from the market.

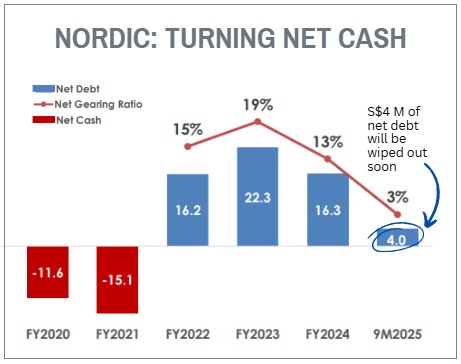

| Almost Net Cash! |

The big takeaway from Nordic’s 9M results isn't just steady profit—it’s the inflexion point where it moves into net cash after paying down $$75 million for three acquisitions made in 2022 and 2023.

|

Nordic Group’s M&A history |

||||||

|

2011 |

2015 |

2017 |

2019 |

2022 |

2022 |

2023 |

|

$29 m |

$26 m |

$17 m |

$14.8 m |

$59.1 m |

$10 m |

$5 m |

|

All are 100% acquisitions paid for in cash. |

||||||

For 9M2025, revenue ticked up 8%, while net profit held firm at $12.7 million, matching the prior year's period.

The net profit margin is keeping pace at roughly 10%, supported by a constant cost base.

The real achievement, however, is net debt (S$4 million) is just weeks or at most a few months away from being wiped out.

Nordic has always been a cash generation machine, churning out average EBITDA of $29 million annually in the past 3 years.

Backed by a healthy total order book sitting at $209.2 million ($137 million of which is steady maintenance work), the business continues to stand on solid foundations.

| Where the Growth Engines Are Revving Up |

1. System Integration: Riding the Shipbuilding Boom

The business of integrating ship systems involving valves and actuators and remote control is doing well, thanks to the buoyant shipbuilding industry in China.

Several Chinese shipyards regularly rely on Nordic's systems.

The money is really in the complex jobs, specifically FPSO (Floating Production Storage and Offloading) conversion jobs.

These involve refurbishing older FPSOs -- it's like a major renovation (or A&A job) on a ship.

Nordic supplies the remote control systems, sensors, electrical components, and software control cabinets needed to upgrade antiquated systems.

For new vessels, Nordic secures the installation business and capture the high-margin after-sales service and spare parts revenue stream.

2.Envipure: Riding the High-Tech Wave

Envipure, which is Nordic's subsidiary in the cleanroom, air and water engineering sectors, is strategically aligned with the booming semiconductor sector, specifically benefiting from the AI-driven chip demand.

This year, Envipure secured S$18 million in purchase orders just from a major memory chip maker in Singapore, said Jeanette Lee, the CEO of Envipure.

Demand isn’t just coming from facility expansion but also from mandatory environmental compliance—clients are upgrading old plants to meet stricter Greenhouse Gas emission requirements.

Looking forward, Envipure is expanding further afield, incorporating a new entity in India (Gujarat).

To manage the cyclical nature of semiconductors, it is also diversifying into water treatment projects in places like Central Asia and Saudi Arabia.

3. Engineering: Defence and Infrastructure

Astro Chang, CEO of StarburstNotable recent contract wins include S$19.8 million worth of work at Tuas South Incineration Plant and unspecified value of scaffolding work at hangars in Changi Airport.

Astro Chang, CEO of StarburstNotable recent contract wins include S$19.8 million worth of work at Tuas South Incineration Plant and unspecified value of scaffolding work at hangars in Changi Airport.

There are some long-term, large-scale opportunities ahead:

- Starburst: This defence-focused subsidiary has a sizable S$40 million project pipeline.

- Avon: The major opportunity is the massive, multi-year relocation of air bases from Tengah and Paya Lebar to Changi expected around 2030.

These fuel management systems projects are enormous.

Nordic’s management stressed that it focuses on stability, disciplined capital management, and consistent dividend payments—a strategy designed to attract long-term value investors. |

|||||||||||||||||

→ The 3Q Powerpoint deck is here.

→ The 3Q Powerpoint deck is here.